Why lame utility will doom your NFT

If you’re an entrepreneur looking to mint your own NFTs, or if you already have a collection of NFTs, and you’re trying to figure out the best way to market them, you’re in the right place.

In this article you'll learn:

- Basic and detailed info about NFTs and why they're relevant

- Why NFT creators need to offer unique and compelling utility

- The five most successful & innovative types of NFT utility

About an 8-minute read.

|

|

Now more than ever, your NFT needs a high-value utility

Those who know about NFTs (Non-Fungible Tokens) know that like any new disruptive product or technology, the crypto and blockchain markets are going through a market correction. Many call it the "crypto winter."

The recent implosion of the digital currency platform FTX has given many investors the jitters. Then Blockfi quickly followed suit. Not surprisingly, most crypto and blockchain-related assets are feeling the pinch.

The same goes for NFTs.

Back in November of 2021, as many as 165,000 NFT sales were made per day. But just a year later, the number of sales is a fraction of that.

It’s not that NFTs have lost all their value. It’s that the laws of supply and demand have taken over. The market is currently saturated, and there aren’t enough buyers. But the demand is likely to return and even stabilize once the economy strengthens, and buyers feel more confident about their own finances.

Like any boom, there are bound to be many gloom and doom predictions. Back in 2000, many “experts” predicted that 98 percent of dot-coms would fail. Others predicted the internet was a fad, with one expert predicting: “The truth is no online database will replace your daily newspaper, and no computer network will change the way government works.”

Oh my. How time changes our perspective.

So what does that say for crypto? While the market must eventually endure the correction, eventually the market will return. Just like in the dot-com era, there’s a lot of opportunity for savvy creators, buyers, and sellers. And now’s the time to get your respective ducks in a row.

Who is likely to buy or sell an NFT?

In most cases, those who buy, sell, own or flip an NFT fall into these two categories:

Creators: This group includes people like graphic artists, illustrators, designers, photographers, musicians, celebrities, social media influencers, gamers, etc. What they all have in common is their ability to make something of value utilizing a strictly digital medium.

Buyers/Sellers: People who typically buy and sell NFTs include art collectors, investors, marketers, fans, etc., as well as entrepreneurs who consider an NFT an alternative asset class. The common link here is the ability to leverage some level of expertise about the art, the artists, the market, etc., to use that expertise to add value and/or profit from their knowledge.

New practical uses for NFTs

Entrepreneurs are seeing the practical benefits of NFTs, which is why they're not likely to go away anytime soon. They provide tangible benefits that appeal to businesses beyond those within the crypto/ digital world.

That’s because they allow for a secure, immutable, transferrable, and verifiable process for transacting business. As such, NFTs can revolutionize industries that exist IRL.

For example, the fine art industry is beginning to use NFTs because they offer permanent provenance for each piece of fine art. Additionally, the industry can expand its market for fine art beyond just the super-rich by fractionalizing ownership into smaller, more affordable segments. Each segment is then auctioned, and the artist can receive a royalty not only the first time it’s sold but each time it is sold.

The real estate industry is another industry that is undergoing radical changes as a result of blockchain and NFT technology.

For the purposes of simplicity, I’ll side-step the huge market for virtual real estate, such as “property” in a game or other virtual environment in the metaverse.

Instead, I’ll focus on real estate owners/investors who convert or “tokenize” an actual deed to a piece of physical real estate. They’ll then “wrap” that tokenized property into a legal entity and then fractionalize it into multiple pieces. Like the art world, this fractional ownership tokenization allows owners to hold one or more fractional shares of the property. Each share is represented as an NFT. Because it’s considered an investment, usually such arrangements in the USA are regulated by the SEC.

A second, less common (and more complicated) form is an entire asset tokenization, where the ownership deed to a property becomes an NFT and is transacted using cryptocurrency. A great example is “Satoshi Island,” the all-crypto island near the Pacific island of Vanuatu, where citizenship and property deeds are sold as NFTs.

In the USA it’s more difficult because most jurisdictions don’t fully recognize a tokenized deed…yet. The industry is waiting for legislation to catch up with the technology. However, real estate startup Propy is the first to offer the technology that allows homes to be bought and sold as NFTs, within certain markets.

State of the NFT Market

As stated earlier, just like the dot-com boom, the crypto market, and NFTs specifically, are bound to endure a period of instability. At first, early adopters and influencers tried to seize the opportunity by diving in headfirst hoping to make as much money as they could before the rules change, or the market became saturated with other sellers. Some of these folks are legit. Others are on the shady side. Many of these early adopters include people of power and/or influence such as celebrities who got in early and profited from their ability to attract the attention of many potential buyers.

As stated earlier, just like the dot-com boom, the crypto market, and NFTs specifically, are bound to endure a period of instability. At first, early adopters and influencers tried to seize the opportunity by diving in headfirst hoping to make as much money as they could before the rules change, or the market became saturated with other sellers. Some of these folks are legit. Others are on the shady side. Many of these early adopters include people of power and/or influence such as celebrities who got in early and profited from their ability to attract the attention of many potential buyers.

But once all the celebrity buzz died down and the shady characters were either arrested or sent into hiding, the NFT market needed to go through a period of adaptation and stabilization, if it has any chance of surviving for the long haul.

That’s where we are right now.

The NFT market looks a lot like the dot-com bust, but with an added challenge called inflation. But this too shall pass. Creators can enjoy this huge opportunity now if they are smart.

The market will favor NFTs that offer real, tangible value, and less on those that are celebrity driven. Creators who lack household name recognition need something other than short-lived buzz to sell their NFTs. They need to deliver real-world value called utility, and without it, an NFT will be ignored and forgotten, like 99% of all other NFTs.

Why utility matters so much

Like any asset, the value of any NFT is subjective. Its true worth is determined by what someone is willing to pay for it.

Utility serves to democratize the marketplace, allowing for value to reign instead of the fickleness of a celebrity’s public reputation.

For all of us non-celebrity entrepreneurs who see great opportunity in selling NFTs as a legitimate, long-term business venture, adding tangible, real-life value to your offering is the only way to survive.

In many ways, your NFT project is much like any mainstream membership organization like AAA or Allstate motor clubs. Without good membership benefits, your members will go elsewhere. It’s not enough to offer a lame benefit that everyone else is offering. To really stand out, you need a suite of compelling, relevant, and valuable benefits, if you want to retain your members long-term.

Utility can help you deliver enough value to attract, acquire and engage your buyers over time. This focus on your value proposition will ultimately determine your success or failure.

That’s why buyers are demanding tangible, IRL value.

Some digital artists and other creators don’t like the growing clamor to offer utility for their NFT creations. Some insist that their artwork is all the utility anyone will ever need, and they only want to sell to buyers who want their art and nothing else. In their mind, a TRUE artist doesn’t need any other utility.

Some digital artists and other creators don’t like the growing clamor to offer utility for their NFT creations. Some insist that their artwork is all the utility anyone will ever need, and they only want to sell to buyers who want their art and nothing else. In their mind, a TRUE artist doesn’t need any other utility.

While it may be tempting to follow that strategy in the name of art, it’s a failing strategy that ignores reality…the reality of market forces. The reality of capitalism.

Fortunately, most creators get it. They understand that their digital artwork has no tangible value outside the virtual world. They understand that although NFT holders have put their money behind their creations, buyers still need a reason to hold on to that asset and not bail on them. Utility is the glue that can help them stay connected and invested.

Types of meaningful utility

Creators also understand that to survive in a competitive market, they must differentiate the quality of the utility they offer. The type of utility you offer will depend on how you want to position your project. Do you want to help your NFT holders make or keep more of their money? Do you want to help them feel better about their investments? Are you trying to help them solve some specific problem?

Here are some common forms of utility, along with some other types of innovative utilities to consider:

1- Access to an Exclusive Community

Probably the most famous NFT is Bored Ape Yacht Club (BYAC). NFT owners enjoy lifetime membership in the BYAC community, which allows them to enjoy members-only access to swanky IRL parties and online games. Others have used a lottery to give away a one-to-one encounter with a celebrity.

Another form of community is found on Discord channels. Most NFTs have a Discord channel as this online community allows NFT owners to interact and collaborate.

2- Merch

Rebel Rabbit NFT collection offers utility in the form of exclusive merchandise and other “physical items” not available to the general public. These items are in addition to other digital items relating to the premise of the story. Another example is CloneX. They not only offer digital fashion within the metaverse, but they’ve also created a line of physical sneakers, clothing, and other items available only to those who own their NFT.

3- Equity/Profit sharing

Offering equity/profit sharing has been around long before Wall Street was ever a thing. What is new is when a publicly traded company uses an NFT to reward and incentivize investors. Biotech company EV Biologics issued NFTs to their shareholders as an alternative to a cash dividend. They issued one Warrant for every 100 shares of common stock. Each Warrant was exchangeable for one NFT worth $300. At the time, their share was selling for $3.50, so a stockholder with $350 in EV stock was able to get $300 worth of NFT. Not too shabby.

4- Airdrops

Airdropping is when an NFT project distributes for free, some of its tokens to users. Typically, the project will set minimum requirements, such as owning a minimum number of NFTs or having a set amount of their cryptocurrency in their wallet. The end result is generating an audience and loyalty.

5- Consumer Discounts

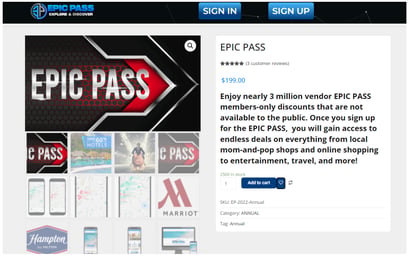

The $65 Billion market for tattoos is ripe for disruption, and that’s what TatTech Inc. hopes to do. Connecting tattoo artists and their followers worldwide, they deliver a host of digital services so artists can mint their tattoo artwork into NFTs. Because these tattoo NFTs are digital, they can be sold on the secondary marketplace. It also allows for an artist in one country to sell a tattoo that can be inked on skin somewhere else. This helps artists sell more of their art to a wider-reaching audience. Within TatTech’s GTM strategy, they offer EPIC pass, a subscription-based discount platform so members can save on tech, travel, dining, etc., along with receiving a free NFT airdrop. It’s a unique approach to expanding utility beyond the limited benefits of tattoos, to instead offering everyday value to help them attract, engage and boost overall loyalty.

The $65 Billion market for tattoos is ripe for disruption, and that’s what TatTech Inc. hopes to do. Connecting tattoo artists and their followers worldwide, they deliver a host of digital services so artists can mint their tattoo artwork into NFTs. Because these tattoo NFTs are digital, they can be sold on the secondary marketplace. It also allows for an artist in one country to sell a tattoo that can be inked on skin somewhere else. This helps artists sell more of their art to a wider-reaching audience. Within TatTech’s GTM strategy, they offer EPIC pass, a subscription-based discount platform so members can save on tech, travel, dining, etc., along with receiving a free NFT airdrop. It’s a unique approach to expanding utility beyond the limited benefits of tattoos, to instead offering everyday value to help them attract, engage and boost overall loyalty.

6- Voting

Some organizations that offer and promote NFTs will allow owners to vote on certain aspects of the governance of the organization.

In the end, value is all that matters

It won’t be long before NFTs will be mainstreamed enough that your grandmother will not only be talking about NFTs, but she’ll know what they are, and may even own one.

Just like the adoption of the internet back in the 1990s, many predicted the internet would become ubiquitous once broadband was universal. But it happened long before broadband became mainstream, as people rapidly embraced the internet despite having only 56K modems. Widespread adoption hinged upon seeing the real, underlying value.

The same will happen with NFTs. Once people see the personal relevance and value of NFTs, they’ll figure out the details of how they work and why they’re valuable, and it will all happen seemingly overnight.

For NFT creators, the real question will be, is your value prop sufficient to differentiate your NFT from the gazillions of others? Or will your project lack enough value that you’ll spend all your time and efforts promoting your project because you’re losing buyers faster than you can acquire them.

Let me know your thoughts in the comments below.

Topics: Customer Engagement, Merchant Discount Network, Discount Programs, Member Benefits, discount networks, VALUE ADDED BENEFITS, Non-fungible tokens, cryptocurrency

Written by: Gary Toyn

.jpg)

.jpeg)

Share your Comment.